Sunday, June 5th, 2016 and is filed under Financing / Mortgage

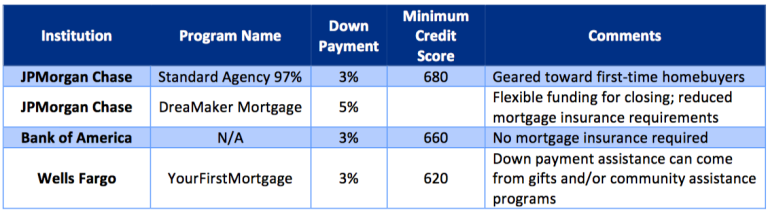

In an effort to reel in younger potential homeowners, at least three of the larger banks – JPMorgan Chase, Wells Fargo and Bank of America – are offering fixed-rate mortgages requiring only 3% down. Some offerings are indicated below[1],[2],[3].

The banks in question, as well as others, are attempting to reel in potential home buyers who might not have been able to save for the standard 20% down. But what’s interesting is that the 3% down isn’t new. The Federal Housing Administration (FHA) has been backing such loans for years.

Overseen by the U.S. Housing and Urban Development, FHA loans also require 3% down. These loans don’t require perfect credit scores. Furthermore, the FHA loans allow down payments to be funded by gifts or grants from state or local government down-payment assistance programs[4].

A borrower doesn’t head to the nearest HUD branch to apply for this type of a loan. Rather, the borrower obtains an FHA loan through an approved FHA lender – in other words, a bank.

Banks Versus HUD

Lenders are shying away from offering FHA-backed loans, over concerns that they’re issued to borrowers with lower credit scores[5]. Another concern is that such loans can go bad more frequently than conventional loans.

Additionally, one underwriting slipup with an FHA loan can lead to charges of violating the False Claims Act. This 19th century law means the U.S. Justice Department can collect a lot of money if it suspects a bank of trying to lie on FHA underwriting.

A Repeat of the Early 2000s?

Do low down payment bank mortgages mean a return to the 2000s? At that time, practically anyone could qualify for a mortgage and own a home, only to find out, just a few years later, that they were unable to afford the payments. After all, 3% down means the bank (not the government) is taking on the remaining 97%.

But there are differences between then and now:

Higher credit scores. Low down-payment mortgages require credit scores higher than 600. This was not the case before the housing crash.

Different mortgage products. Many of the homeowners were sucked into the so-called “teaser” rates on jumbo adjustable rate mortgages in early to mid-2000s. When those mortgages readjusted to a higher interest rate, homeowners couldn’t afford the mortgage. The simple solution was to walk away, meaning foreclosure. Lenders these days offer ARMS – but the low teaser rates are things of the past.

Scarce supply. As we’ve mentioned in previous blogs, there isn’t much supply for entry-level home buyers. For example, while the Wells Fargo program offers a mortgage to cover a $417,000 house (which is the limit that Fannie Mae and Freddie Mac, the two government housing agencies, allow). But the applicant might not have enough salary for monthly payments on such a home.

In summary, banks offering mortgages with ow down payments doesn’t mean that we’re headed for another housing disaster. Instead, it seems as though banks are trading one low down payment plan – the FHA – for another – their own.

[1] M. Geffner (2015). Seven Crucial Facts About FHA Loans. Retrieved from Bankrate.com: http://www.bankrate.com/finance/mortgages/7-crucial-facts-about-fha-loans-1.aspx

[2] Banks Rush to Offer 3% Down Payment Loans. (2016, May 27). Retrieved from Realtor Magazine: http://realtormag.realtor.org/daily-news/2016/05/27/banks-rush-offer-3-down-payment-loans?om_rid=AAEi5K&om_mid=_BXSJy4B9OGACxp&om_ntype=RMODaily

[3] B. Lane (2016, May 26). Chase Quietly Launches its Own 3% Down Mortgage Lending Program. Retrieved from HousingWire: http://www.housingwire.com/articles/37128

[4] D. Olick (2016, May 26). Wells Fargo Launches 3% Down on Payment Mortgage. Retrieved from CNBC: http://www.cnbc.com/2016/05/26/wells-fargo-launches-3-down-payment-mortgage.html

[5] K. Berry (2015, September 28). JPMorgan Leads Big Banks Out of the Door of FHA. Retrieved from National Mortgage News: http://www.nationalmortgagenews.com/news/compliance-regulation/jpmorgan-leads-big-banks-out-the-door-of-fha-1062309-1.html